infrastructure investment and jobs act tax provisions

Its duties under the Water Infrastructure Protection Act WIPA or the Act in reviewing a Municipal Certification of Emergent Conditions. The expenditure authority for the Highway Trust Fund through FY2026 the.

Myths And Facts Infrastructure Investment Jobs Act

House of Representatives tonight passed HR.

. Search and apply for the latest Infrastructure support specialist jobs in Piscataway NJ. While the bulk of the law is directed toward massive. Active transportation infrastructure investment program.

While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water and broadband improvement there are some tax-related provisions included. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked.

Transportation Infrastructure Finance and Innovation Act of 1998 amendments. Free fast and easy way find a job of 896000 postings in Piscataway NJ and other big cities in USA. The Employee Retention Tax Credit ERTC which was a tax credit enacted under the.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. Roads bridges and major projects.

On January 16 2018 Governor Christie signed Senate Bill 3305 S33051 modifying New Jerseys tax credit transfer provisions under the Grow New Jersey Assistance Act and the Public Infrastructure Tax Credit Program as follows. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. The legislation includes tax-related provisions.

This title extends several highway-related authorizations and tax provisions including. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. The BBBA could have significant provisions regarding the Child Tax Credit the cap on the state and local tax deduction and limits on the business interest expense deduction.

The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. The Infrastructure Investment and Jobs Act will end the Employee Retention Tax Credit early and create new workforce development.

Almost three months after it passed the US. The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. The vote was 228 to 206.

Thus congressional action of this bill has been. New Jersey recently adopted the Uniform Prudent Management of Institutional Funds Act UPMIFA replacing the 1975 Uniform Management of Institutional Funds Act UMIFA. The Act requires the submission of a copy of the resolution certifying an Emergent Condition and this document identifies the recommended supporting information will that aid DEP in rendering a timely decision.

Almost three months after it passed the US. Federal requirements for TIFIA eligibility and project selection. 3684 the Infrastructure Investment and Jobs Act.

Almost three months after it passed the US. Tax-related provisions in the Infrastructure Investment and Jobs Act. While the bulk of the law is directed toward massive investments in.

The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. Full-time temporary and part-time jobs. Infrastructure Investment and Jobs Act.

Gain or income derived from the sale or assignment of certain tax credit transfer certificates is. Both UPMIFA and UMIFA provide rules for how certain wholly charitable institutions including hospitals universities and their foundations should make investment decisions. Highway cost allocation study.

Senate passed the same version of the bill on August 10 2021 on a bipartisan basis. President Biden signed the bill into law on November 15. Among other provisions this bill provides new funding for infrastructure projects including for.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. Almost three months after it passed the US. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Taxadda Off Campus Drive 2022 Hiring For Frontend Engineer Intern Position B E B Tech Bca Mca Engineering Jobs Campus Jobs Electrical Jobs

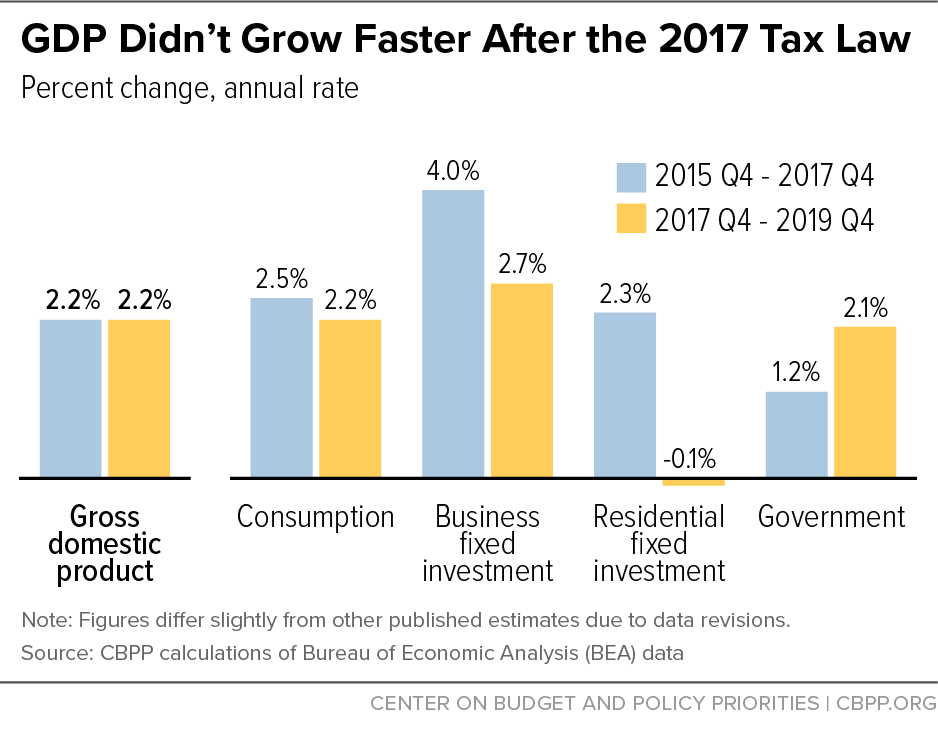

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

The Inflation Reduction Act Is A Victory For Working People Afl Cio

How The Tcja Tax Law Affects Your Personal Finances

Myths And Facts Infrastructure Investment Jobs Act

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Here S President Biden S Infrastructure And Families Plan In One Chart The New York Times

Here S President Biden S Infrastructure And Families Plan In One Chart The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/22682182/D8LI9_the_senate_infrastructure_deal_leaves_out_br_a_lot_of_climate_friendly_policies.png)

The Senate Infrastructure Deal Leaves Much Of Biden S Climate Plan For Reconciliation Later Vox

How The Tcja Tax Law Affects Your Personal Finances

The Infrastructure Plan What S In And What S Out The New York Times

How The Tcja Tax Law Affects Your Personal Finances

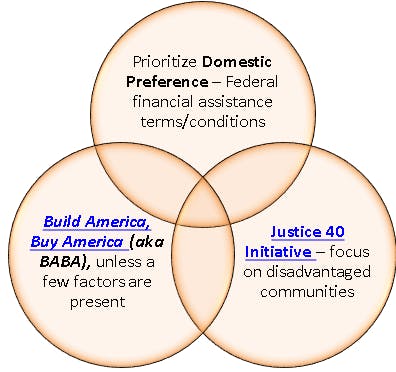

Infrastructure Investment And Jobs Act Iija Implementation Resources

Workers In These States Would Pay Most Under Biden S New Business Tax The Heritage Foundation

What India Must Do To Fulfill Its Desire To Become A Global Powerhouse Is Clear Slash Income And Business Tax Rates And Simplify Th India Business Tax Imagine

What Are The Economic Effects Of The Tax Cuts And Jobs Act Tax Policy Center

Infrastructure Investment And Jobs Act Iija Implementation Resources